What does banking of the future look like? Digital transformation in banking is currently being used to shift banks to the cloud and employ emerging technologies. This move to leveraging new technology, also known as Banking 4.0, is all about combining efforts of data, compliance, and technology to improve the customer experience and meet users where they are.

What is Digital Transformation in Banking?

Digital transformation in banking is not just one thing. Instead, it represents a variety of steps banks may take to integrate their digital technologies and modernize their systems to improve the customer experience, operations, business innovation, and risk management. When banks engage in digital transformation, they’re doing so to keep up with the evolving expectations of the end-user and to remain competitive within the financial industry.

Some key technologies associated with digital transformation in banking include online banking, cloud computing, artificial intelligence and machine learning (AI/ML), mobile banking, and big data analytics. In fact, mobile banking is widely used by all ages – 89% of users take advantage of mobile banking, as well as 97% of all Millennials.

However, these initiatives can’t happen without an internal cultural shift that embraces new technology.

What Are the Key Benefits of Digital Transformation in Banking?

Banking businesses that invest in digital transformation can improve their productivity and ability to adapt to a changing technological landscape. They can also innovate faster, make decisions with greater ease, and improve the experience for the end user.

Faster Business Innovation

Digital transformation efforts within the banking industry are reshaping and elevating traditional processes, resulting in remarkable efficiency and operational excellence. Leveraging the capabilities of digital technologies, banks optimize their performance which fosters streamlined operations and robust automation.

Cloud-based solutions and services are leading the way for this transformation, offering advantages like:

- Real-time data analytics

- Scalable infrastructure

- Secure and compliant storage

With the use of these technologies, IT leaders can automate complex tasks, resulting in better accuracy and increased speed in data analysis, transactions, and customer interactions. This automation opens doors for innovative services and more personalized customer experiences while improving overall efficiency.

Increased Productivity and Adaptability

Think about the tasks your employees do every day. Key, repetitive activities can often be automated through digital transformation projects, streamlining workflows and opening up more time for more sophisticated, strategic work. By automating tasks, the banking industry can also decrease the likelihood of errors, reducing risk levels from these activities.

Organizations that are digitally transformed can respond more quickly to new technologies and easily scale their infrastructure when faced with changes in demand.

Improved Security and Compliance

Security improves with automation, but digital transformation in banking can also mean adding stronger security measures to your organization. AI/ML technology can identify patterns indicative of fraudulent activity. Businesses can implement multifactor authentication (MFA) to provide additional layers of security during the login process, which can include physical keys or biometric markers. Cloud-based security solutions are often easier to update, providing current security technology without requiring infrastructural upgrades.

Enhanced Decision Making

When an organization is more connected, and data is made more visible, this can also enhance the decision-making process. Banks can use big data analytics to identify patterns and uncover new insights. They can also employ user experience (UX) audits to observe how customers are using the services and where they might be getting stuck. Because these insights are coming from a well-informed place, financial organizations can make more cost-effective changes without wondering whether their efforts will be useful to actual users.

Better Customer Experience

User expectations have changed dramatically in recent years. Digital check deposits and robust mobile banking weren’t always the norm, but in today’s world, customers want the banking process to be as straightforward as ordering from their favorite online store. With digital transformation, banks can focus on delivering more personalized banking experiences, as well as omnichannel banking. Data analytics and generative AI can help continue to deliver tailor-made experiences for the end user, improving satisfaction and increasing retention rates.

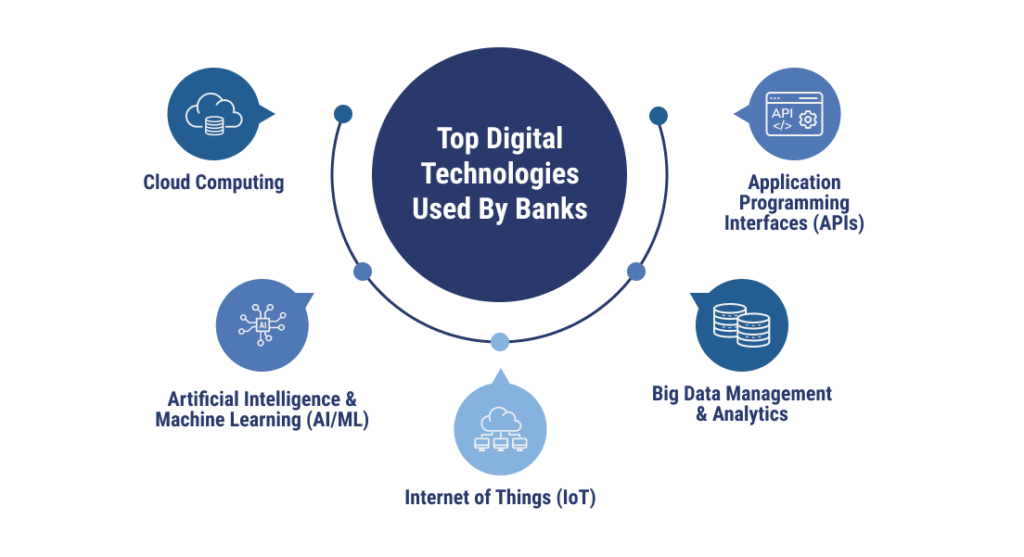

Top Technologies Leveraged by Modern Banks

The banks that are ahead of the pack with digital transformation are employing technologies such as cloud computing, artificial intelligence, big data management, and APIs to meet and exceed customer expectations, as well as improve their internal processes.

Cloud Computing

Shifting to cloud computing is often one of the first steps a business takes as part of their digital transformation journey. Traditional, on-premises infrastructure can be inflexible and difficult to modernize. Migrating to a cloud computing framework allows organizations to take advantage of cloud-first and cloud-native applications that are easier to manage and update. Cloud computing also offers more options and resources compared to traditional frameworks.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning (AI/ML) can play a role in many different parts of your business. Generative AI, as demonstrated by large language models and tools like ChatGPT, can personalize customer experiences by using preferences and use cases to deliver more relevant solutions. AI/ML can also, as previously mentioned, automate repetitive tasks or uncover previously unseen patterns.

Internet of Things

In simple terms, the Internet of Things (IoT) is all about connecting physical objects to the internet. Banks could harness IoT for several use cases, including smart safes, smart ATMs, and onsite branch sensors. Wearable devices could even be used for customer identification purposes or to monitor spending habits.

Big Data Management and Analytics

Digital transformation projects often improve the ability to collect and see a larger quantity of data produced by a bank. This creates opportunities for big data analytics, which could be done through cloud monitoring tools, business intelligence (BI) software, or other integrated solutions. When used well, data analysis can illuminate paths to new products and services, identify areas for improvement, and unveil security and compliance vulnerabilities.

APIs

Application programming interfaces (APIs) serve as the connectors between back-end technologies and front-end systems. New services that cater to fintech, software as a service (SaaS), digital currencies, and other emerging technologies can be connected to current back-end systems to add new features and improve the user experience.

5 Tips for Successful Digital Transformation in Banking

Banks can feel like a hard ship to turn. Breaking digital transformation down into steps can help make the process feel more manageable.

Understand Your Technical Debt

Determining what needs improvement is the first step when making an action plan to narrow the gap. Technical debt can appear in your organization in the following forms:

- Manual processes that could benefit from automation

- Compliance gaps

- Cybersecurity shortcomings

- Dips in system performance

- Poorly written code

- Out-of-date legacy frameworks

Once you understand your technical debt, it’s time to begin working with appropriate team members to begin addressing it.

Identify Any Skills Gaps

Nothing can improve without the right team in place to tackle relevant issues. Chances are, your IT team won’t have all of the skills necessary to solve all issues associated with technical debt.

According to a recent Tech Talent Report by CIO, 42% of survey respondents said talent gaps are slowing their IT modernization initiatives while 37% of companies have suffered project delays or total cancellations due to sparse available IT talent.

Many of the skills gaps in IT related to digital transformation, include emerging technologies, app integration, cloud infrastructure, modernization, and cybersecurity. Coupled with a small talent pipeline, these gaps may need to be addressed by supplementing your current team with external support.

Craft an Outcome-Focused Strategy

After you have a complete understanding of your technical and talent needs, it’s time to develop a strategy focused on outcomes. Banks shouldn’t be taking on digital transformation just because it’s trendy.

There needs to be a specific outcome in mind that teams are working to build. This could look like improving the mobile banking experience, personalizing customer portals, creating financial education apps, or digitizing and automating internal manual processes. Your outcome will determine your action plan.

Build a Solid Cybersecurity Framework

Security, digital transformations, and IT skills gaps are closely connected. Top cybersecurity concerns for organizations include data loss prevention, firewalls, antivirus safeguards, and cloud security. Whether it’s with your team or a cybersecurity expert, develop a framework that’s built with the cloud and these emerging technologies in mind.

Utilize DevOps Best Practices

Software development and IT operations join forces on a DevOps team. Using DevOps best practices can help financial institutions develop software more efficiently and effectively. DevOps teams work to automate development, version software through gradual changes, and collaborate regularly throughout the process. Banks that employ DevOps best practices can remove the silos between teams and develop software with greater accuracy, speed, and cost-efficiency.

Choosing the Right Cloud Provider for Your Digital Transformation

As we’ve mentioned, cloud is at the center of many digital transformation projects, and choosing the right cloud provider should not be a decision that is taken lightly. Reviewing your options and migrating to cloud infrastructure doesn’t have to feel like an impossible task. TierPoint is here to help with cloud consulting services and other solutions that can assist you in your digital transformation journey.

Is your team prepared for your digital transformation? Download our eBook to learn the technical skills and resources you need to pull off a successful transition to the cloud.

FAQs

Digital transformation in banking can involve a wide variety of measures aimed at improving the customer experience, growing the business, and streamlining internal processes by employing new, technological tools.

Evolving customer expectations, the rise of fintech, and the ever-changing compliance landscape are all reasons that digital transformation is more important than ever for financial institutions. Digital transformation also provides additional opportunities for organizational growth.

Many banks experience challenges on the way to digital transformation. Legacy frameworks, cultural resistance, compliance struggles, and inadequate in-house expertise can halt digital transformation projects.