January 16, 2025 | Matt Pacheco

How to Leverage AI in Fintech in 2025: Use Cases & Benefits

New AI developments are unveiled daily, with innovations touching every industry. For financial technology (fintech) companies, AI can bring a lot of value, but it also needs to be approached thoughtfully to be applied ethically and in a way that protects sensitive customer data. We’ll cover what AI means for the Fintech sector, how it could be applied to companies, and risks to look out for.

What is AI in Fintech?

AI in fintech refers to leveraging artificial intelligence to enhance financial services by identifying trends from historical data, improving overall security and management, automating tasks, and enabling strategic initiatives. This process improves financial services by maximizing efficiency and giving employees time for planning and strategic client meetings. Artificial Intelligence and Machine Learning can also provide personalized financial advice tailored to customer profiles and goals.

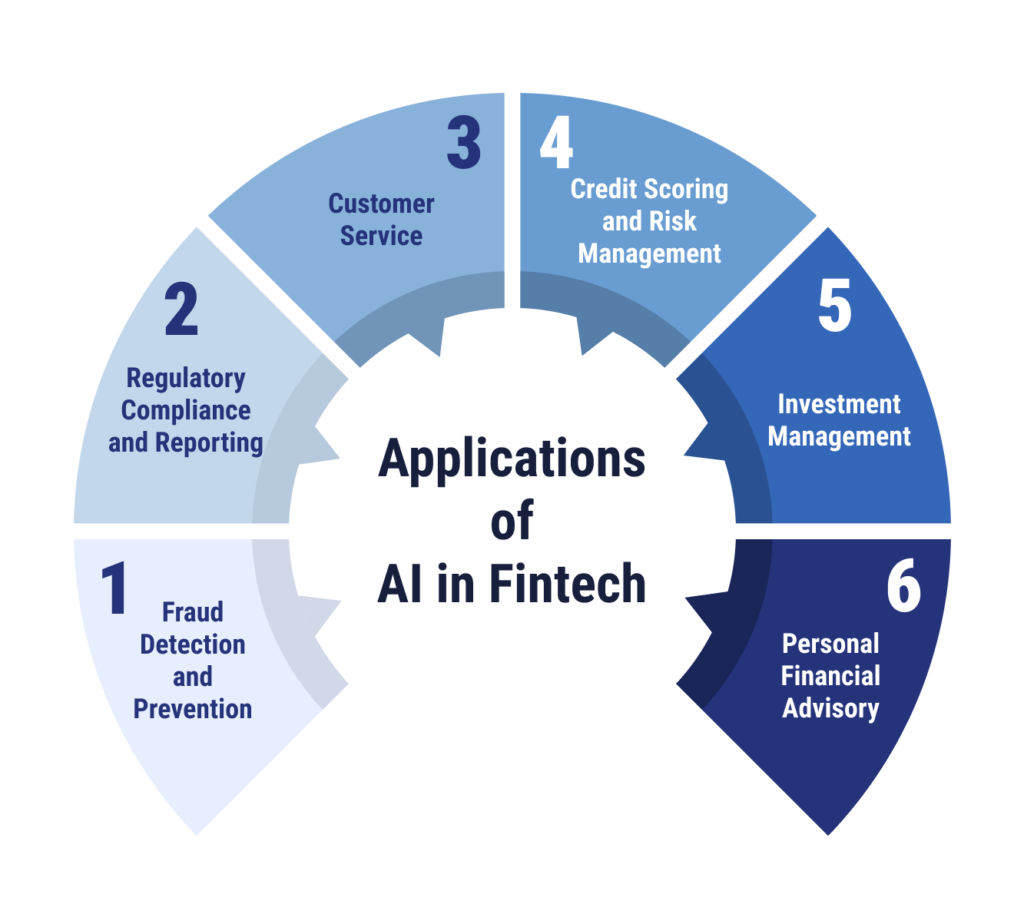

Key Areas of AI Application in Fintech

Fraud Detection and Prevention

AI-powered fraud detection systems can perform automated checks of financial transaction data and learn from typical patterns to identify anomalies that may be associated with fraudulent behaviors. Machine learning algorithms can iterate on past findings to identify new fraud patterns, making prevention easier and more effective over time.

Regulatory Compliance and Reporting

Companies in the fintech industry may need to abide by multiple regulatory standards and be required to generate reports, regularly monitor environments, and validate their data. AI algorithms can help automate all of these tasks, and machine learning algorithms could be trained to pinpoint potential regulatory breaches before organizations get penalized or fined.

Customer Service

Chatbots powered by AI can offer round-the-clock support to customers coming to a website or application for common issues. They can also be used to automate escalation to a human if the customer has more complex needs. This can help customer service representatives save more time for these critical queries.

Credit Scoring and Risk Management

Credit scoring and risk management models that are driven by AI can bring in a wider range of data sources to assess creditworthiness, such as other online behavior that may not normally be tracked by credit bureaus. This could help reduce credit risk for lenders.

Investment Management

Customers looking for investment management without the fees associated with personalized service could benefit from AI-powered investment management tools that learn and adapt based on market trends, identifying automated investment opportunities that can optimize portfolios based on data-driven models.

Personal Financial Advisory

Similarly, fintech solutions can offer personal financial advisory services based on individual needs and goals around saving, budgeting, investing, and retirement planning. AI tools can offer programmatic suggestions based on customer risk profiles, investment goals, and current financial positions.

Benefits of Leveraging AI Tools in Fintech

Better Accuracy and Efficiency

One of the best ways to improve accuracy in operational processes is by automating manual tasks that can be prone to error. AI-powered tools are incredibly effective at improving accuracy for routine processes. This technology can also analyze large datasets and make quicker, more accurate insights, allowing employees to make data-driven decisions more quickly and have time left to focus on more strategic initiatives.

Improved Customer Experience

Instead of waiting for someone to be available during working hours, AI chatbots can give customers answers to most common issues 24/7 and even provide personalized recommendations after learning more about certain users. This can help improve customer satisfaction and loyalty.

Reduction in Costs

A reduction in errors and time spent on repetitive tasks can reduce operational costs. AI-driven fraud detection systems can also keep fintech businesses from experiencing significant financial losses.

More Opportunity for Personalization

Fintech companies can also use what is learned about customers to tailor products and financial services to their market more accurately. Personalization can be applied on the level of the customer base, as well as to the individual user, to make the experience feel more customized.

Challenges of AI Fintech

Data Privacy and Security Concerns

To be accurate and useful, AI models need to train on large amounts of data. In the case of fintech, this can mean sensitive financial data, which can be a bigger target for cyberattacks and data breaches. If this data is compromised, it can lead to financial loss, reputational damage, and regulatory sanctions.

Ethical Considerations and Bias

Fintech companies also need to be mindful of the ethical implications of using this data to train AI models, as well as the bias that may be present in a model that some may assume is more objective. If too much bias is introduced into the model, unfair or discriminatory outcomes can result. Large, representational datasets are necessary for effective training.

Regulatory and Compliance Challenges

As AI continues to develop, the regulatory landscape will also have to keep up. The data regulations that fintech companies will have to be compliant with in the future will look different from how things look today. AI systems need to be designed in a way that adheres to current regulations, and they need to be adaptable to future compliance measures as well.

Dependency on Data Quality

The more data is up to date, clean, and accurate, the more effective AI models will be. Incomplete data and poor-quality information can lead to inaccurate recommendations that keep customers from achieving their goals.

The Future of Fintech with AI and ML

We’re only just starting to see what the future holds for AI/ML technologies in fintech. The advancements we’ve seen in the past few years are likely small hops compared to the jumps that may be on the horizon. What is certain is that the future of fintech will bring improved customer interactions, predictive analytics advancements, greater operational efficiencies, and more personalized experiences for individual users.

If you want to ensure that your fintech company is advancing with the speed of AI/ML progress, consider partnering with a provider that offers data center options that can scale with your technologies, migration support to help you modernize your systems, and consulting to help you plan for what’s next.

Accelerate Your Fintech Business with AI

TierPoint understands the transformative power that AI/ML tools can bring to fintech businesses. If it’s time to accelerate your operations, we can help you find the implementations that are right for you. Learn more about business applications of artificial intelligence and machine learning and speak to one of our experts about harnessing the power of AI for your fintech business today.